general aggregate insurance meaning

Aggregate limits are commonly included in liability policies. The aggregate insurance definition is the highest amount of money the insurer will pay for all of your losses during a policy periodthis period typically lasts for one year.

How Much Does General Liability Insurance Cost The Hartford

Looking for information on Designated Construction Project General Aggregate Limit Endorsement.

. Business owners typically deal with aggregate insurance coverage in their general liability insurance policy. That might represent a single large claim or multiple smaller. Understanding when this limit takes effect can mean the difference between a vendor having coverage or being underinsured.

What does in the aggregate mean. General Aggregate Limit the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. Plus as legal costs are covered separately each claim effectively has a.

On the other hand umbrella liability policies will respond to those claims which arise in case of a catastrophic loss which is more than the per occurrence limit under. The aggregate limit in your commercial insurance policy is the maximum amount your insurer will reimburse you for all covered losses within the term of your policy. This means that coverage will pay for every claim loss and lawsuit that involves a policyholder until it reaches that aggregate limit.

The general aggregate limit on a CGL insurance policy defines the total amount the insurer will pay during a single policy period usually a year. Many insurance policies including commercial general liability policies have per occurrence limits meaning that they will pay up to a certain amount of money per occurrence. Insurers use aggregate limits to protect themselves from unexpectedly large individual payouts allowing them to keep premiums affordable for all customers.

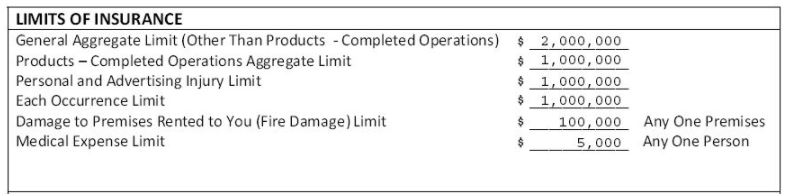

This means that in this example individual claims have a limit of 1000000 each while the total policy coverage for all claims made. The general aggregate limit places a ceiling on the insurers obligation to pay for. A general aggregate sets the limits of your commercial general liability CGL policy.

The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. Unsure about what aggregate insurance is and why there is a limit. IRMI offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere.

The aggregate limit of. Keep in mind that the aggregate insurance limit is on. Unlike a per-occurrence limit which limits the amount per claim a general aggregate limit can be exhausted through either two claims fifty claims or anywhere in between.

An aggregate limit is a contract provision used in insurance to limit the amount that can be paid in the policy period. So what does the general aggregate mean. This may lead the company owner to believe that if a house his crew is working on is damaged in a fire his insurance company will cover the damage up to the amount of 2000000.

The aggregate insurance definition is the most your policy will pay for all losses you sustain over a given period of time usually a year. For insureds aggregate limits can serve as tools for customizing their insurance coverage to appropriately reflect their risk exposure and available budget. Under the standard commercial general liability CGL policy the general aggregate limit applies to all covered bodily injury BI and property damage PD.

General aggregate is the policy limit of liability for the policy term. This policy covers legal costs in many situations. The general aggregate limit restricts the amount that would be paid by the commercial general liability insurance policy irrespective of the number of claims and occurrences.

A liability cap may be hiding in plain sight known as the general aggregate limit. The aggregate limit of liability is the most an insurer is obligated to pay to an insured party during a specified period. On certain types of insurance coverage an aggregate limit is put in place.

When you reach your aggregate limit your insurer will pay no additional claims during the policy period. General aggregate represents the maximum amount a policy pays out across all claims. A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures.

In commercial general liability insurance the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. The aggregate limit is usually double the occurrence limit. The construction company owner above may have a 2000000 aggregate limit with a 1000000 per occurrence limit which means his insurance company will only pay.

The term is also known as general aggregate limit of liability which is the maximum amount of money an insurance company will pay for claims losses and lawsuits that happen during the active period of your policy typically one year. However other general liability coverage policies will have something along the lines of a 1000000 per occurrence limit and a 2000000 general aggregate limit excluding products-completed operations. This article details the three different applications of the general aggregate limit and some common pitfalls that impact coverage.

Lets say your policy has a general aggregate liability limit of 10000. A general aggregate is a crucial term in commercial general liability insurance which is necessary for all policyholders to understand. If your aggregate level of cover is 1m youre looking at a 400k.

Aggregate 1 a limit in an insurance policy stipulating the most it will pay for all covered losses sustained during a specified period of time usually a year. Under some commercial general liability CGL policies the general aggregate limit applies to all covered bodily injury BI and property damage PD except for injury or. While not often used in property insurance aggregates are sometimes included with respect to certain.

We know that general aggregates can be confusing. The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. Aggregate limits are commonly included in.

Aggregate 1 A limit in an insurance policy stipulating the most it will pay for all covered losses sustained during a specified period of time usually a year. What does general aggregate mean in insurance. If youve been sued for 4000 and 5000 already this year and now youre being sued for 2000 your insurance company will only pay the first 1000 of the final claim.

Aggregate Limit Of Liability. Click to go to the 1 insurance dictionary on the web. The general aggregate limit in your commercial insurance policy refers to.

The General Aggregate Limit What Is It Landesblosch

The General Aggregate Limit What Is It Landesblosch

Saxe Doernberger Vita P C Project Specific Commercial General Liability Insurance

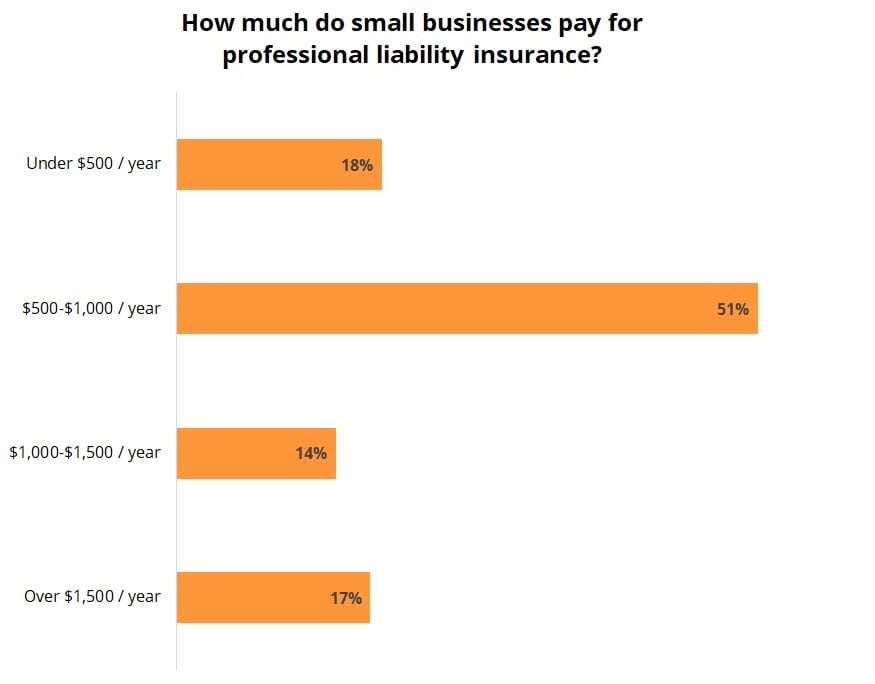

Professional Liability Insurance Cost Insureon

In The Aggregate Vs Any One Claim What S The Difference Ashburnham Insurance

What Is The Difference Between Per Occurrence And Per Aggregate Crowley Insurance Agency

How Much Does General Liability Insurance Cost The Hartford

Saxe Doernberger Vita P C Project Specific Commercial General Liability Insurance

How To Read An Insurance Certificate Real Estate Nj

General Liability Insurance Cost Llc Insurance Cost

The Corridor Self Insured Retention Expert Commentary Irmi Com

In The Aggregate Vs Any One Claim What S The Difference Ashburnham Insurance

What Is General Liability Insurance Small Business Insurance Simplified

What Are Aggregate Limits And Per Occurrence Limits In My General Liability Insurance Policy

The General Aggregate Limit What Is It Landesblosch

The General Aggregate Limit What Is It Landesblosch

The General Aggregate Limit What Is It Landesblosch

/GettyImages-801982414-3919def938ba436e8a85ade3c6926bb6.jpg)

:max_bytes(150000):strip_icc()/imitation-of-a-house-in-a-chain-on-a-lock-on-a-gray-piece-of-concrete-on-a-beige-pastel-background--1133455818-33c850555bb14795a46fade3d2e34a17.jpg)

0 Response to "general aggregate insurance meaning"

Post a Comment